Nice Tips About How To Handle Credit Card Default

Unlock money secrets with the official financial ed program of the ncaa®.

How to handle credit card default. Unlock money secrets with the official financial ed program of the ncaa®. If you are unable to pay off your debt in full, you don’t need to go straight to bankruptcy or ignore your. How to answer a civil summons for credit card debt by settling it.

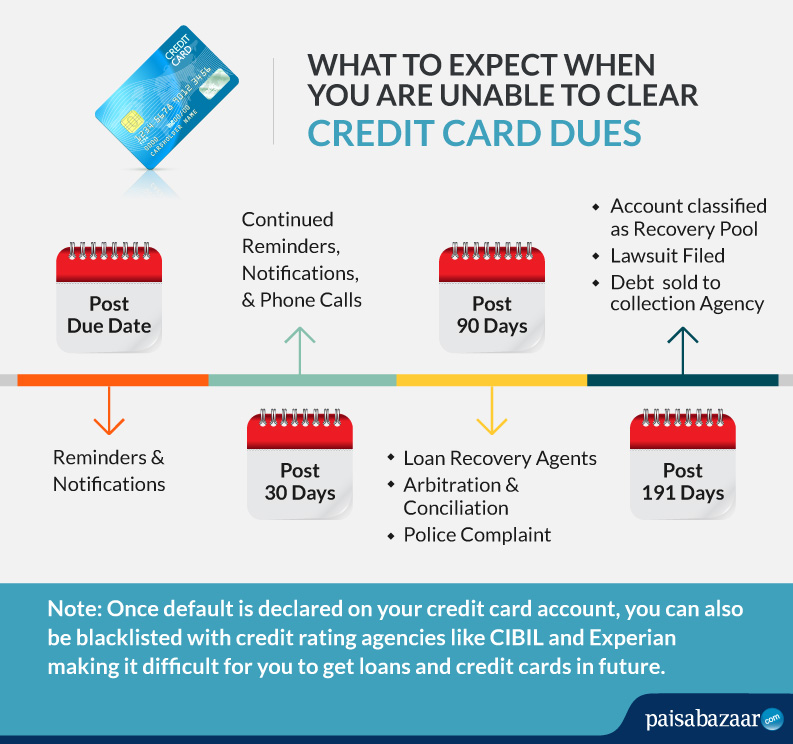

Ad learn when the game is live & learn valuable financial lessons like tackling student debt. Ad learn when the game is live & learn valuable financial lessons like tackling student debt. If you wait too long before making a payment, the credit card company may use a collection agency to attempt to collect the debt.

Similar to debt settlement companies, attorneys can work on your behalf but typically charge fees for their work. There are many ways to handle credit card defaults. You should start by paying off any outstanding debts that.

Pay your account in full. About 2 months after not making payments i got a letter from one company that was willing to cancel my card, and take half of the principal in 3 payments. If you think a debt settlement.

The key to negotiating credit card debt is showing permanent hardship while protecting what resources your parents do have in case a lawsuit results in a judgment. Your creditor may eventually send you a settlement. Recovering from a default and reversing the damage caused to your credit scores are neither quick nor easy, but they can be done.

I did that, it seemed a good deal. There’s also an additional option for handling your credit card debt default. Also, negotiate for a ‘pay for delete’ according to which your credit card.